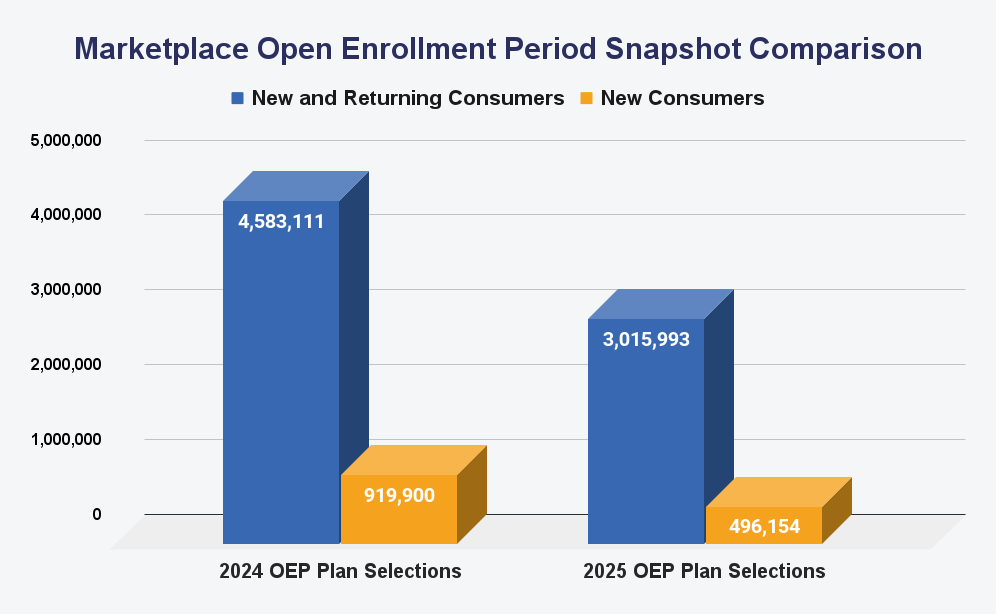

Healthcare.com outlines potential reasons for the decline in ACA Enrollment and how a direct year-over-year correlation is complex.

Key factors to consider include the introduction of a three-way verification process to prevent unauthorized plan switches, the shift of states like Georgia to state-based exchanges, Special Enrollment Periods, and other data discrepancies.

In 2024, the ACA marketplace faced several challenges that impacted enrollment numbers, resulting in a 31.2% year-over-year drop in returning ACA consumers.

One key change is introducing a three-way verification process (agents, consumers, CMS) in July 2024. While designed to curb unauthorized plan switching, it has also slowed down legitimate plan changes, reducing overall switches.

Second, new state exchanges, like Georgia, which shifted from a federal marketplace to a state-based exchange, removed roughly 300,000 enrollees from the federal count.

Other factors complicating the comparison include the impact of the election year, which could have delayed individuals’ priorities when voting season overlapped with health insurance shopping.

Additionally, the Special Enrollment Period which ran from April 2023 through 2024, gave individuals who lost Medicaid coverage a chance to secure health insurance through the ACA marketplaces without waiting for the annual Open Enrollment Period (OEP). This shift had significant implications for enrollment numbers in 2024, contributing to an influx of new consumers seeking coverage through the marketplace.

Data discrepancies between federal and state exchanges, ongoing premium increases, and uncertainty around last year’s data accuracy add another layer of complexity.

A report from the Paragon Health Institute, a conservative think tank, noted that “the problem of fraudulent exchange enrollment is much more severe in states that have not adopted the ACA’s Medicaid expansion as well as in states that use the federal exchange”.

The Centers for Medicare and Medicaid Services (CMS) recently announced that the agency received about 90,000 complaints of unauthorized sign-ups or plan switches in the first quarter of 2024.

These unique factors underscore the difficulty in comparing ACA enrollment numbers year over year. For health insurance professionals, adapting strategies to these shifting dynamics is critical to navigating the evolving market and effectively engaging consumers.