Overview

If you choose Original Medicare (Parts A and B) rather than Medicare Advantage, an additional Medicare Supplement plan or “Medigap insurance” pays for healthcare expenses not covered by Original Medicare.

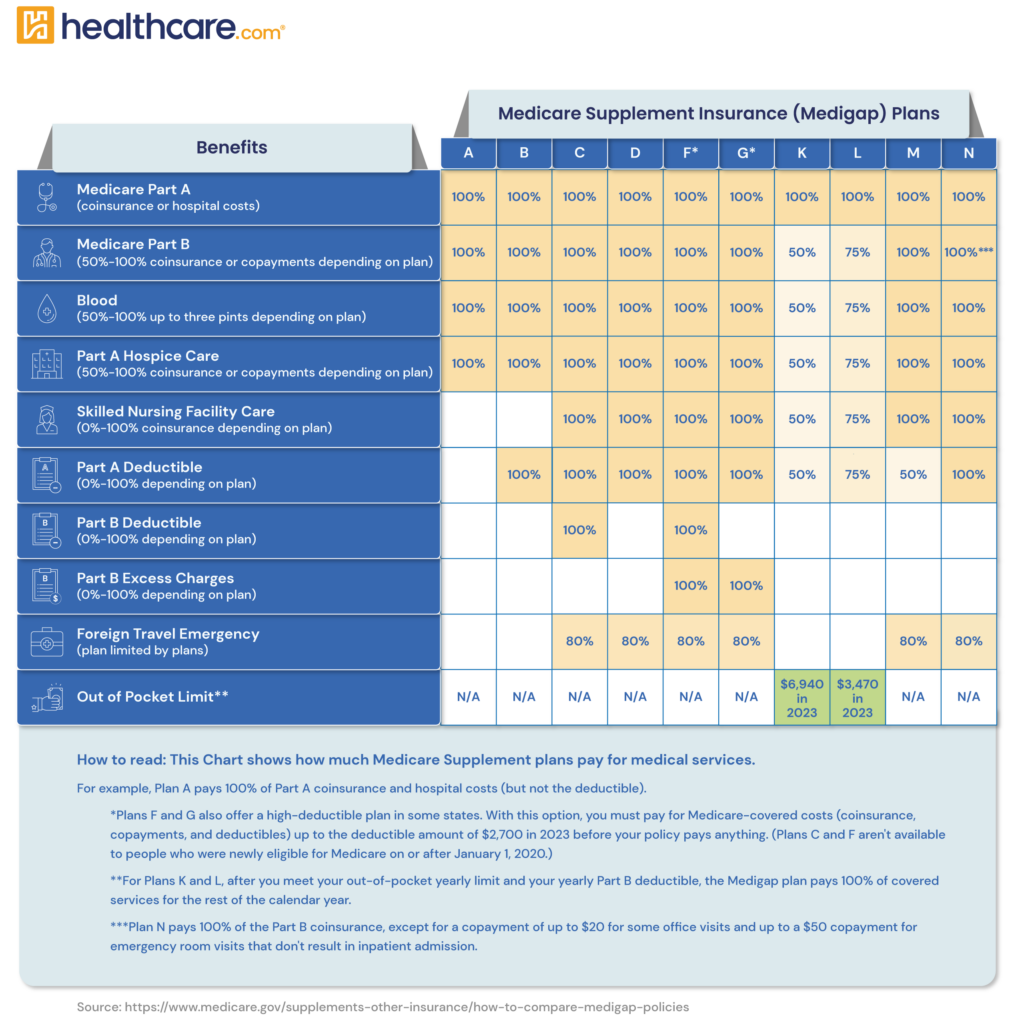

Once you start looking around, you’ll see there are a variety of plans, each identified by a letter: A, B, C, D, F, G, K, L, M, and N.

These plans can cover the following:

- Medicare Part A (coinsurance or hospital costs)

- Medicare Part B (50%-100% coinsurance or copayments depending on plan)

- Blood (50%-100% up to three pints depending on plan)

- Part A Hospice Care (50%-100% coinsurance or copayments depending on plan)

- Skilled Nursing Facility Care (0%-100% coinsurance depending on plan)

- Part A deductible (0%-100% depending on plan)

- Part B deductible (0%-100% depending on plan)

- Part B Excess charges (0%-100% depending on plan)

- Foreign Travel Emergency (limited by plan)

These plans can help pay for up to 20% of medical costs that aren’t covered by Original Medicare (Parts A and B).

How do you enroll?

You can enroll in a Medicare Supplement plan without penalty or underwriting during your initial 7-month Medigap Open Enrollment Period. Once you’ve enrolled in Original Medicare, you can choose a Medicare Supplement plan using Healthcare.com’s plan selector.

How much does it cost?

The monthly premium you pay for your Medigap policy is based on the plan you choose and what the insurer charges. The most popular, Plan G, typically costs $100 to $300 per month, with prices varying based on location, gender, and age.

Most important now is considering what you will have to pay out-of-pocket in the event that you need care Medicare doesn’t cover. All Medicare Supplement Insurance plans to pay the Medicare Part B coinsurance, whether fully or partially, since it is a basic benefit. Plans A through G cover many benefits at 100%, so you wouldn’t have any out-of-pocket expenses for Part B covered.

Next Steps

The upside of Medicare is that it gives you a lot of plans to select from. The downside is that it can be difficult to pick the right plan with the vast number of options available. It is beneficial to spend some time assessing plans and insurance companies that offer coverage in your area.

With standard plans, it makes comparison less complicated. Consider the premiums of the same plan from various insurance companies to determine the winner. Calculate the numbers before settling on a plan. Sometimes, spending a lower premium while you’re healthy can enable you to save money in the future when you may need more services.

Consult a Medicare expert nearby that can help you get rates for different plans and compare companies.