A Summary of Benefits and Coverage (also called an SBC) is a tool that was created in 2010 as part of the Affordable Care Act. A basic Summary of Benefits and Coverage is designed to help you understand what’s covered by your health plan. Since SBCs present information in a uniform way, you can also use them to directly compare insurance plans. SBCs effectively provide a quick snapshot of your plan’s coverage, without requiring you to dive into complex legal documents from your insurance company.

Every Obamacare health insurance plan will provide members with a Summary of Benefits. If you have trouble finding the SBC for your current health insurance plan (or a plan that you’re considering) call your plan’s provider. If you receive your insurance through your job, you can also ask your human resources department.

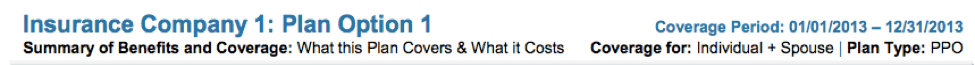

What’s Up Top? Plan Name, Length of Coverage and More

Descriptive Information

On the top of each Summary of Benefits and Coverage, you can find the name of the insurance company and the name of the plan. The header will also list the plan’s coverage period, which is the maximum length of time the plan will last for.

Confirm the Plan Type

Your plan will probably be a PPO, HMO, EPO, or POS. This will determine what medical providers are in your plan’s network, and how you can get in touch with them.

“Coverage for” Tells You What You’ll Need to Pay

This “Coverage for” line in this section will confirm who the plan covers – whether it’s just an individual (you), individual + spouse, individual + child, or an entire family. This will be important as you read your Summary of Benefits, because deductibles and out-of-pocket maximums often vary by the number of people covered per plan.

Important Questions

The Important Questions section explains your financial obligations under the plan. The basic information that you need for budgeting will be addressed on the first page of the Summary of Benefits.

What Is the Overall Deductible?

The deductible is how much you’ll pay on your own each year before the plan begins paying for your covered services. Usually an SBC will include an individual and a family deductible. This corresponds to the “Coverage for” listed in the top header of the SBC. There may also be separate deductibles for in-network and out-of-network services. This doesn’t apply to preventative care.

Are There Other Specific Deductibles?

Some plans have separate deductibles for specific items, like pharmaceutical costs. In this case, you would have to meet the separate deductible for pharmaceutical costs before the plan begins to pay for this specific category of medical costs.

What Is the Out-of-Pocket Maximum?

Health insurance plans will let you off the hook for medical costs once you’ve spent a high amount of money on your own. This amount, known as an out-of-pocket maximum, is the most this plan will have you pay each year. The out-of-pocket maximum does not include the portion of bills paid by the health insurance plan. Similar to a deductible, the out-of-pocket amount may differ for in-network and out-of-network services.

Is There an Overall Annual Limit on What the Plan Will Pay?

All plans that were created after 2014 have no annual limits on what they pay each year. Your SBC for health insurance will have a line about overall annual limits to emphasize that there is no annual limit on what your plan will pay.

However, plans may put annual limits on certain services. Many plans will institute a maximum number of chiropractor or mental health visits per year.

Does This Plan Use a Network of Providers?

Almost all health insurance plans make use of a “provider network”. Any plan with a provider network will strongly encourage you to use that network.

Visiting a doctor outside of the network may subject you to a separate deductible or higher costs. You can find your plan’s cost-sharing info for participating and nonparticipating providers in the Common Medical Events section of the SBC. Some plans will not let you visit medical professionals that are outside of your provider network.

If you are ever unsure if a doctor you want to see is in the network, call your health insurance provider to check.

Do I Need a Referral to See a Specialist?

Your plan’s referral procedure will depend on your plan type. Specific plan types, like HMOs, require you to have a referral before seeing a specialist. Other plan types allow you to visit anyone without a referral. You could be subject to out-of-pocket charges if you see a specialist without following your plan’s referral rules.

Are There Services This Plan Doesn’t Cover?

All Affordable Care Act-compliant plans (the most common type of coverage) will cover 10 essential health benefits that most Americans would expect to be a part of their insurance policy.

There will almost always be incidental services, like medical care in foreign countries, that a plan doesn’t cover. Plan exclusions can be found further down on your Summary of Benefits.

Common Medical Events

This section will help you prepare for the unexpected. The Common Medical Events section walks you through the costs of likely ways your plan will be used. Charges for office visits, diagnostic tests, pregnancy, and more are broken down in detail.

This section will also note the difference in cost if you use a provider that’s outside of your plan’s network.

This is also where you can see if you have a limitation or exemption to a service, such as chiropractic visits or children’s eye exams.

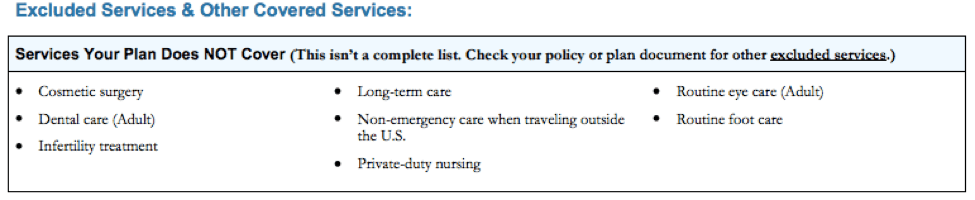

Excluded Services & Other Covered Services

It is important to note that a Summary of Benefits doesn’t include every exclusion in your plan. While the SBC will list the most asked-about exclusions, you will need to read more detailed plan documents to get a comprehensive list. Common exclusions include:

- Long-term care,

- Cosmetic surgery,

- Dental and vision services for adults,

- Weight loss programs.

- Acupuncture, and

- Infertility Treatment.

Similarly, the Other Covered Services section is not a full list, but it offers a quick snapshot of some other services covered by your plan that are not laid out in the Common Medical Events section.

Rights & Appeals

If you have made it this far, you have a great understanding about what your plan offers from a coverage and financial standpoint. The next section reminds you of your rights as a consumer, and includes information about how to file a grievance or appeal. There should also be a statement that certifies the plan meets the minimum essential coverage as specified by the ACA.

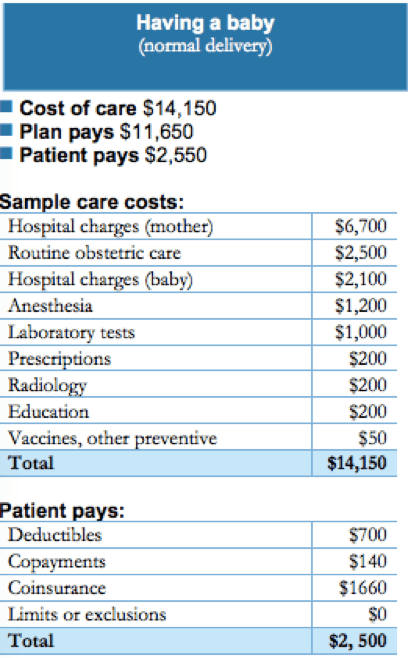

Examples of a Summary of Benefits and Coverage

The Summary of Benefits will then give two or three examples of how the plan will pay in certain situations. This helps you understand how your deductible, copay, and coinsurance would apply. Types of examples will vary by SBC and they are not to be used as official estimates for the cost of a service.

SBCs were implemented to serve as a window into what was previously a muddy and complex system. Understanding your health policy and how it works is the first step in becoming an educated healthcare consumer. This tool will help you compare available health services, and how they will affect you financially.

Taking the Next Steps

If you’re still deciding on a health insurance plan and you need to find a way to figure out which plan makes the most sense for your needs, make sure you know how to read a Summary of Benefits and Coverage. You can also do this through HealthCare.com’s comparison tool.

For More Reading: