The health insurance Open Enrollment Period for 2018 lasts only 45 days. HealthCare.com provides insight on the abbreviated timeline and other notable changes to watch out for.

Miami, FL and New York, NY (October 27, 2017) – Despite efforts from the federal government to reform the Affordable Care Act, the 2018 health insurance Open Enrollment Period – the time when Americans can change Obamacare health insurance plans or a join a new plan for the upcoming year – will still begin on November 1, 2017. But this has left most Americans confused about how this year’s open enrollment differs from the previous three.

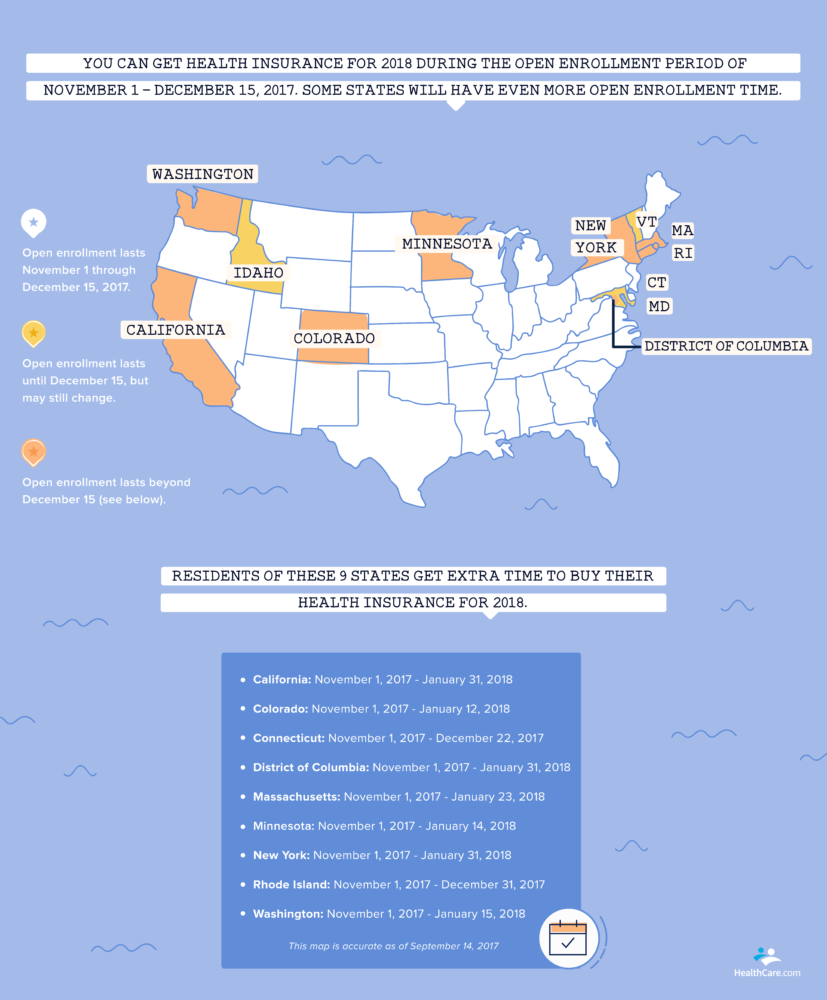

Unlike previous Open Enrollment Periods, which each occurred over a 90-day window, this year’s open enrollment will last just 45 days – starting on November 1 and lasting until December 15. The shortened timeframe means Americans will have less time to make decisions about their healthcare. While some U.S. states have extended the enrollment period for their individual state exchanges (notably, California and New York), most states will follow the condensed 45-day enrollment window.

There are several major changes to the open enrollment process in addition to the condensed 45-day enrollment window. It’s likely that many consumers will be caught off-guard, as these changes to open enrollment have not been well publicized. HealthCare.com cofounder and CEO, Howard Yeh, explains how these open enrollment changes may affect consumers and the coverage options available to them.

1. Changes to Re-Enrollment:

“In previous enrollment periods, people were provided with several government notices to compare their current plan with other healthcare plans on the Marketplace. This year, it’s unclear whether consumers will be provided those notices. That’s why it’s important to shop around for a different health insurance plan during open enrollment. If consumers don’t compare their plan options, they run the risk of being re-enrolled in the same plan after the enrollment period has already passed. If their current plan’s monthly premium is set to increase, they may get stuck with a plan that doesn’t fit their needs, or is otherwise unaffordable.”

2. The End of Subsidies Towards Cost-Sharing Reductions:

“The Trump administration has decided to stop financing cost-sharing reduction (CSR) subsidies to insurance companies. Most insurers predicted this and, as a result, raised the prices for Silver plans (the only plans for which these cost-sharing reductions were made available). This means higher insurance premiums and out-of-pocket costs for some. This also means, though, that people in some areas of the country may encounter Gold and Platinum plans that cost just as much or even less than Silver plans.”

3. Fewer Insurers, Fewer Options:

“Several insurers have filled in the gaps left by the exit of major insurance companies like Aetna and Anthem from the Marketplace. While this ensures that consumers across the country have healthcare options available to them, the options are significantly slimmer than those in previous years. In many areas of the country, only one ACA health plan option will be available to consumers – and with costlier premiums that may be prohibitive for many.”

4. Higher Costs Overall:

“Costs for ACA plans overall will be higher compared to previous years – with insurers charging, on average, 20% more on premiums. These costs have outpaced income growth, leading to a unique affordability gap – where people make too much to qualify for Obamacare tax credits, but make too little to actually afford a Bronze plan. Under the law, those unable to afford a Bronze plan are exempt from paying the penalty for not having health insurance (referred to as the “Marketplace affordability exemption”). This year, we expect more than 1.5 million people to qualify for that exemption – a significant increase from the 600,000 two years ago.

5. Less Government Assistance:

“The federal government has also slashed funding for different initiatives intended to encourage and support people enrolling in Marketplace coverage. Notably, there will be less help available from ‘navigators’ (unbiased guides who are trained to help people navigate the Obamacare exchanges), and government spending on Obamacare outreach and advertising is now virtually nonexistent. This means it’s up to consumers to actively seek out help when signing up – and it’s up to nonprofit organizations and private companies to step up and make sure consumers get the information they need.”

6. Decrease in Participation Due to Rise of Alternatives to Traditional Health Insurance:

“Motivated by increasing costs and limited options, more consumers are moving towards alternatives to ACA health insurance. Relatively unknown healthcare options, like association plans and faith-based healthcare, are becoming more popular. And people may start using short-term health insurance plans – which typically serve as temporary coverage solutions – as full-time replacements to traditional coverage, especially since the president’s executive order now allows these plans to last up to a year (compared to the previous limit of three months).”

Approximately 20 million people will shop for health insurance during this Open Enrollment Period. HealthCare.com, a top destination for consumers looking to shop around for the best-priced plan, offers both non-Marketplace and Marketplace health insurance, as well as alternatives to ACA coverage (like short-term health insurance plans). Just in time for this open enrollment, the company’s website features a revamped consumer experience – with an enhanced search-and-compare platform that better informs and suggests plan options based on consumers’ needs, as well as a new, comprehensive information hub – ensuring healthcare shoppers can make better-informed decisions about their coverage.

For important updates throughout open enrollment, follow HealthCare.com on Facebook, Twitter, or visit HealthCare.com/info for more information.

About HealthCare.com

HealthCare.com is a privately-owned search-and-compare health insurance shopping platform that connects consumers with its network of licensed insurance brokers and insurance carriers. The website’s origins can be traced back to 2006, but launched as a new company in 2014 as a technology- and data-driven platform to help the American consumer efficiently compare health insurance costs and subsidies. The company ranked #148 on the 2017 Inc. 500 list of fastest-growing companies in America.

HealthCare.com serves the individual health insurance market (offering both ACA and non-ACA plans) and the over-65 health insurance market (offering Medicare Supplement and Medicare Advantage coverage options). The company has helped more than 3 million people find healthcare coverage. HealthCare.com has offices in New York City, Miami, and Guatemala City. For more information, visit www.healthcare.com.

PRESS CONTACT

Ronald Barba

Director of Content & Community, HealthCare.com

rbarba@healthcare.com

SOURCE: HealthCare.com

RELATED LINKS: https://www.healthcare.com, https://www.healthcare.com/