Healthcare debt impacts Americans differently across generations.

HealthCare.com’s 2022 Medical Debt Survey shows about one in four Gen Zers and Millennials with medical debt skipped rent or mortgage payments because of their debt.

Close to half of Millennials and Gen Xers with medical debt say the debt harmed their credit score.

68% of Gen Zers who have health insurance but still incurred medical debt say their health insurance plan didn’t cover the service they received.

More than half of U.S. adults with incomes below $25,000 and medical debt had their bills sent to debt collectors.

Scroll down for survey details.

HealthCare.com Medical Debt Survey 2021: Demographic Analysis

Key Findings

One in four Gen Zers and Millennials with medical debt skipped rent or mortgage payments because of their debt

Close to half of Millennials and Gen Xers with medical debt say the debt harmed their credit score

Two in three Gen Zers who have health insurance but still incurred medical debt say their health insurance plan didn’t cover the service they received

More than half of U.S. adults with incomes below $25,000 and medical debt had their bills sent to debt collectors

Americans of different generations experience unique struggles when it comes to medical debt.

HealthCare.com’s survey shows that, among U.S adults with medical debt, about one-quarter of Gen Zers (25%) and Millennials (23%) skipped rent or mortgage payments because of their debt.

Close to half of Millennials (52%) and Gen Xers (48%) with medical debt say their healthcare debt has harmed their credit score. Fewer Baby Boomers (43%) or Gen Zers (42%) with medical debt have experienced this.

Different generations have different plans for repaying their medical debt.

22% of Baby Boomers with medical debt plan to dip into their retirement savings.

Meanwhile, a generation-leading 22% of Gen Zers with medical debt say they’ll turn to crowdfunding to pay their healthcare bills.

Americans are also skipping purchases because of medical debt.

For Gen Z (53%), Gen X (44%), and Baby Boomers (40%) with medical debt, the most common reason is travel.

For Millennials with medical debt, home improvement (43%) comes in at the top of the list.

Across generations, majorities are worried that their medical debt will affect their ability to save, with Millennials being the most likely to say they are somewhat to extremely concerned (67%).

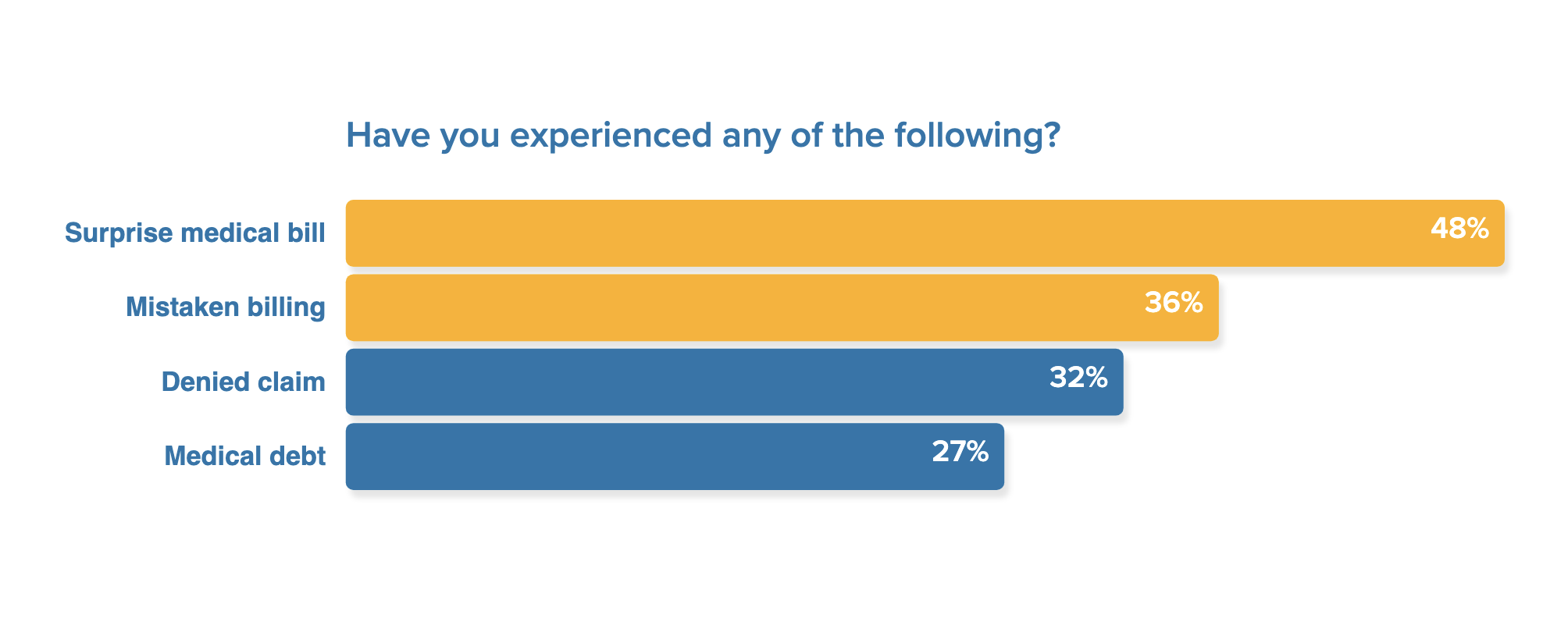

Debt Triggers Vary by Generation

68% of Gen Zers who have health insurance but still incurred medical debt say their health insurance plan didn’t cover the service they received (or they received services out-of-network).

Fewer than half of other generations say the same.

About three in 10 Gen Zers (31%) and Millennials (27%) with medical debt believe that their debt is the result of a billing error.

Among Gen Xers (21%) and Baby Boomers (20%), slightly fewer believe this was the case.

Health triggers for medical debt vary depending on the generation.

The most common cause of medical debt for Gen Z and Millennials was seeking care following an accident/injury (26% and 25%, respectively).

For Gen X, the most common trigger was chronic disease, such as cancer or heart disease (18%).

A similar number of Baby Boomers (17%) cited chronic disease as the top cause of medical debt.

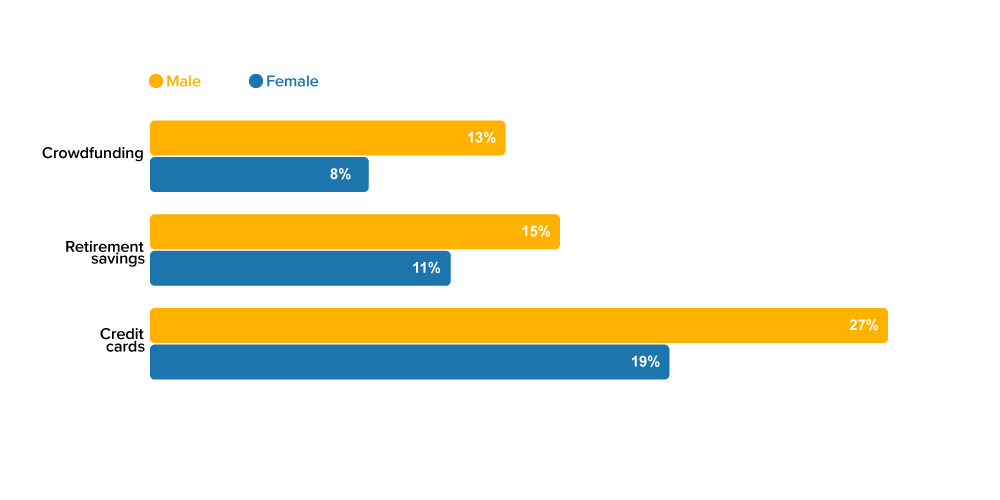

Men More Likely than Women to Crowdfund Medical Debt

Though men and women are similarly likely to have medical debt, they may take different approaches when it comes to paying it back.

Men are more likely than women to turn to credit cards (27% vs 19%), retirement savings (15% vs 11%), or crowdfunding (13% vs 8%) to pay their medical debt.

They’re also more likely to try and get their debt reduced: 55% of men and 45% of women with medical debt say they’ve tried to negotiate their debt down.

The triggers of medical debt vary by gender.

Men (18%) with medical debt are more likely than women (10%) with medical debt to say their top medical expense was related to chronic pain.

Among men with healthcare debt, the top medical expense causing debt was accident/injury (21%).

For women with medical debt, the most common reason was chronic disease (17%) followed closely by accident/injury (16%).

Lower Income Groups Harried by Debt Collectors

Income naturally plays a role when it comes to medical debt.

Among those with medical debt and an income below $10,000 (60%) or between $10,000-$24,999 (52%), at least half have had their bills sent to debt collectors.

23% of those with an income under $10,000 say they will turn to crowdfunding to obtain funds to pay their medical debt.

The most common source of funds for repaying debts among this income group (and in fact, all income groups surveyed) is their salary.

Americans with lower incomes are more likely to feel anxious about their medical debt.

Among those earning between $10,000 and $25,000, about one in five (21%) say their debt causes “extreme stress.”

Looking at medical debt across the nation, majorities in each region (between 58% and 75%) say they received healthcare services knowing that they would result in medical debt.

Methodology: HealthCare.com conducted this survey utilizing a SurveyMonkey Audience on October 29-November 1, 2021, among a national sample of 2,852 U.S. adults aged 18+. The modeled error estimate for this survey is plus or minus 2.0 percentage points. The sample was balanced for age, gender, and U.S. Region according to the Census Bureau’s American Community Survey.