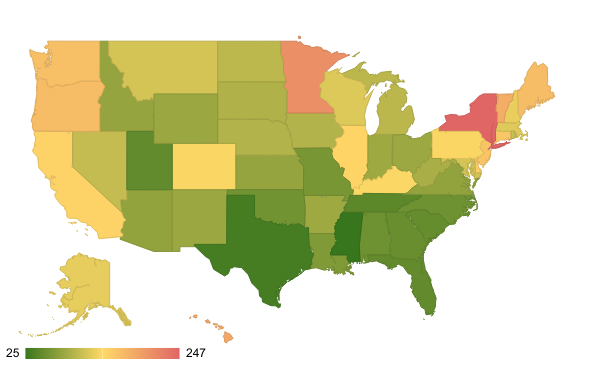

A Snapshot of Average Costs After Subsidies

As the 2025 Open Enrollment period approaches, many Americans are eager to understand their health insurance options under the Affordable Care Act (ACA).

Average premiums after subsidies this year vary significantly across the country, according to data* from the Centers for Medicare and Medicaid Services (CMS).

ACA subsidies, or Premium Tax Credits (PTC) or Advance Premium Tax Credits (APTC), lower your monthly health insurance payments.

In 2024, your eligibility is based on your projected income and the benchmark plan cost. You qualify for subsidies if you pay more than 8.5% of your household income towards health insurance.

Nationwide, the numbers reflect regional differences in healthcare costs.

Nationally, the average premium stands at $74, a decrease from the previous year, $88.

In terms of individual states, Mississippi boasts the lowest average premium at just $25, making healthcare more accessible for its residents.

Looking for Health Insurance?

Find Plans that meet your health needs and budget.

| Location | Open Enrollment 2023__Average Premium after Subsidy | Open Enrollment 2024__Average Premium after Subsidy |

| United States | $88 | $74 |

| Alabama | $75 | $55 |

| Alaska | $125 | $122 |

| Arizona | $105 | $75 |

| Arkansas | $104 | $82 |

| California | $134 | $143 |

| Colorado | $143 | $133 |

| Connecticut | $153 | $153 |

| Delaware | $144 | $147 |

| Florida | $59 | $49 |

| Georgia | $66 | $52 |

| Hawaii | $140 | $183 |

| Idaho | $79 | $77 |

| Illinois | $147 | $141 |

| Indiana | $125 | $82 |

| Iowa | $105 | $93 |

| Kansas | $97 | $77 |

| Kentucky | $124 | $134 |

| Louisiana | $94 | $65 |

| Maine | $130 | $163 |

| Maryland | $117 | $112 |

| Massachusetts | $118 | $118 |

| Michigan | $121 | $98 |

| Minnesota | $203 | $207 |

| Mississippi | $45 | $25 |

| Missouri | $94 | $61 |

| Montana | $133 | $112 |

| Nebraska | $104 | $93 |

| Nevada | $104 | $103 |

| New Hampshire | $149 | $124 |

| New Jersey | $170 | $156 |

| New Mexico | $91 | $80 |

| New York | $279 | $247 |

| North Carolina | $67 | $55 |

| North Dakota | $96 | $99 |

| Ohio | $117 | $81 |

| Oklahoma | $73 | $57 |

| Oregon | $155 | $164 |

| Pennsylvania | $140 | $133 |

| Rhode Island | $111 | $106 |

| South Carolina | $60 | $50 |

| South Dakota | $85 | $92 |

| Tennessee | $72 | $45 |

| Texas | $43 | $33 |

| Utah | $49 | $48 |

| Vermont | $175 | $178 |

| Virginia | $86 | $75 |

| Washington | $160 | $160 |

| West Virginia | $128 | $88 |

| Wisconsin | $127 | $117 |

| Wyoming | $97 | $80 |

Other states with low premiums include Florida at $49 and Texas at $33.

Conversely, New York has the highest average premium at $247, followed by Hawaii at $183 and Vermont at $178.

States like California and New Jersey also report higher premiums, at $143 and $156, respectively.

As individuals prepare for Open Enrollment, this data emphasizes the importance of comparing options based on state-specific costs and available subsidies.

Data Source/Notes

*The data in this table represent Marketplace enrollment activity for the 2017, 2018, 2019, 2020, 2021, 2022, 2023 and 2024 Open Enrollment Periods.

Marketplace Open Enrollment Period Public Use Files for [2017-2024](https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products) Centers for Medicare and Medicaid Services (CMS), Department of Health and Human Services.

The Affordable Care Act (ACA) provides financial assistance through advance premium tax credits (APTCs) and cost sharing reductions (CSRs) for low and moderate income people who purchase coverage through the Marketplace. Under the Inflation Reduction Act, up through 2025, individuals are eligible for APTCs if they have incomes of at least 100% of the federal poverty level and not be eligible for public coverage (e.g., Medicaid or Medicare) or have access to coverage through an employer. Recent legal immigrants who do not qualify for Medicaid may be eligible for tax credits even if their income is less than 100% of the poverty level.