Listen to the audio version of the guide:

Understanding Medicare & Medicaid

What’s Medicare?

Medicare is a federal health insurance program designed for:

- Individuals aged 65 or older

- People under 65 with certain disabilities

- Individuals with EndStage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS)

Medicare Parts Overview

Original Medicare includes:

Part A (Hospital Insurance) which covers:

- Inpatient care in hospitals

- Skilled nursing facility care

- Hospice care

- Home health care

Part B (Medical Insurance): which covers:

- Services from doctors and other healthcare providers

- Outpatient care

- Home health care

- Durable medical equipment (e.g., wheelchairs, walkers)

- Preventive services (e.g., screenings, vaccines)

Medicare Part D (Drug Coverage): Helps cover prescription drug costs, including many vaccines. It is available through standalone plans or as part of Medicare Advantage Plans.

Medicare Advantage Plans (Part C): Provided by private companies, these plans bundle Part A, Part B, and usually Part D coverage. They may offer additional benefits like vision, hearing, and dental services but might have network restrictions and require prior approval for some services.

Medicare Supplement Insurance: Additional insurance offered by private companies designed to help cover out-of-pocket costs not covered by Original Medicare (Parts A and B).

Original Medicare vs. Medicare Advantage

- Original Medicare: Offers flexibility to use any Medicare-approved doctor or hospital. You may purchase supplemental insurance (Medigap) to cover out-of-pocket costs.

- Medicare Advantage: Provides a managed care alternative that often includes additional benefits but may limit your provider choices and require pre-authorization for certain services.

Medicare Advantage plan benefits can include coverage for:

- Dental/Vision

- Inpatient hospital and skilled nursing care

- Emergency and urgent care

- Doctor visits, surgery, and preventive care

- Medical equipment like wheelchairs and walkers

Additional benefits may include:

- Grocery assistance

- Gym memberships

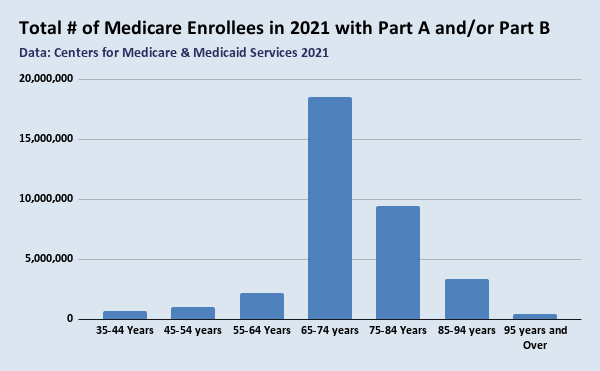

Medicare Advantage: 2023 Total Enrollment, by Plan Type | KFF

In 2023, Medicare Advantage enrollment totaled over 30 million in the U.S., with Florida leading at 2.7 million and Wyoming having the lowest at just 13,051. Source: KFF

What’s Medicaid?

Medicaid is a joint federal and state program that assists with medical costs for individuals with limited income and resources. It covers services not typically included in Medicare, such as nursing home care and personal care services. Eligibility varies by state, and some states allow a “spend down” of excess income to qualify.

Dual Eligibility

Medicare and Medicaid: If eligible for both, Medicare generally pays first for covered services, followed by Medicaid. Medicaid may cover some drugs not included under Medicare.

For more information:

- Visit Medicare.gov for details on plans, costs, and providers.

- Call 1800MEDICARE (18006334227) for personalized help.

- Contact your local State Health Insurance Assistance Program (SHIP) for free, local counseling.

- Government Resources: Medicare.gov Guide to Medicaid and Medicare

Explore resources at Medicare.gov/basics/costs/help/medicaid for Medicaid details.

Signing Up For Medicare

Do You Need to Apply for Medicare?

- Automatic Enrollment: If you’re 65 and already receiving Social Security or Railroad Retirement benefits, you’re automatically enrolled in Medicare Part A and B.

- Manual Application: If you’re not receiving benefits and lack employer health coverage, you need to apply as you approach age 65.

How to Apply for Medicare:

Apply via the My Social Security account. Verify your identity with a:

- Social Security number

- Valid U.S. mailing address

- Email address

- Date and place of birth

- Permanent Resident Card (if applicable)

- W2 and tax forms

- Medicaid number (if applicable)

- Group health insurance details (if applicable)

After applying, keep your confirmation number to check your application status.

When to Enroll:

- Initial Enrollment Period: Around your 65th birthday.

- General Enrollment Period: January 1 to March 31 each year.

- Special Enrollment Period: When leaving employer health coverage.

Medicare vs. ACA Health Insurance Marketplace

If you have Affordable Care Act (ACA) Marketplace coverage, you should generally sign up for Medicare when first eligible to avoid coverage delays and potential penalties.

About ACA Marketplace Plans

The ACA or Obamacare, was introduced in 2008 to reform health insurance. It created Health Insurance Marketplaces to simplify coverage access and provide financial assistance.

ACA plans offer a variety of affordable options for millions, including those self-employed or between jobs.

Key Features:

- Marketplace: Enroll via HealthCare.gov or state-based platforms to compare insurance options.

- Pre-Existing Conditions: Coverage cannot be denied due to pre-existing conditions.

- Subsidies: Eligible individuals and families can receive tax credits to lower monthly premiums.

You can keep your Marketplace plan until Medicare starts. However, once you qualify for premium-free Part A or already have Part A, you may need to end your ACA coverage to avoid paying back subsidies.

Medicare Resources

- Visit Medicare.gov

- Read your “Medicare & You” handbook

- Contact your State Health Insurance Assistance Program (SHIP)

Understanding Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance, commonly known as Medigap, is additional insurance offered by private companies designed to help cover out-of-pocket costs associated with Original Medicare. Here’s what you need to know:

Coverage: Medigap helps with costs not covered by Original Medicare, such as:

- Copayments

- Coinsurance

- Deductibles

- Foreign travel emergency care (not covered by Original Medicare)

Explore our health insurance term glossary to better understand different costs.

Eligibility

To purchase a Medigap policy, you must:

- Have Original Medicare (Part A and Part B)

- Not be enrolled in Medicare Advantage Plans, Medicaid, or other types of health coverage like TRICARE or employer health plans

Policy Features:

- Standardization: Medigap policies are standardized and identified by letters (e.g., Plan A, Plan B, Plan C, etc.). All policies of the same letter provide the same basic benefits, regardless of the insurer.

- Availability: There are ten Medigap plans available in most states, each with varying levels of coverage. Note that Plan C and Plan F are not available to new Medicare enrollees after January 1, 2020, due to changes in coverage for the Part B deductible.

- Coverage Differences: Plans D and G offer different benefits depending on when they were purchased, and plans E, H, I, and J are no longer sold but can be kept if already held.

Buying Tips:

The optimal time to purchase a Medigap policy is during your Medigap Open Enrollment Period, which starts the first month you are 65 and enrolled in Medicare Part B.

During this time, you can choose any Medigap policy without medical underwriting.

Plan Pricing:

Medigap policies are priced in different ways—community-rated, issue age-rated, or attained age-rated—which can impact your premium costs.

What’s Not Covered

Medigap does not cover:

- Long-term care

- Vision and dental care

- Hearing aids and eyeglasses

- Private duty nursing

Medicare Supplement Resources

- For more information on Medicare Supplement, visit theMedicare.Gov “Medicare & You’ Handbook.

- Need Local Help With Medicare? State Health Insurance Assistance Programs offer personalized, one-on-one insurance counseling and Medicare assistance.

Understanding Medicare Coverage and Costs

Navigating Medicare can be complex, but understanding what’s covered and how much you might pay is essential for managing your healthcare expenses. Medicare generally covers services and items deemed “medically necessary” to treat diseases or conditions. Here’s a concise guide to help you understand what Medicare covers and your potential costs:

What Medicare Covers:

- Medically Necessary services include hospital stays, surgeries, lab tests, and doctor visits.

- Medically Necessary items include durable medical equipment like wheelchairs and walkers.

Factors Affecting Coverage:

- Federal laws define Medicare benefits, while state laws may dictate what services providers can offer.

- National Coverage Determinations: Medicare establishes national coverage for specific items and services.

- Local Coverage Determinations Local companies process Medicare claims and decide if services are covered in specific areas.

- Specific Conditions: Some services or items may only be covered in certain settings or if specific conditions are met. For instance, organ transplants must be done in approved hospitals.

Finding Coverage Information:

- Discuss with your healthcare provider about the necessity of services or items and whether Medicare will cover them.

- Visit Medicare.gov/coverage: Check if specific tests, items, or services are covered.

- Review the “Medicare & You” Handbook which provides information on coverage under Medicare Part A (hospital insurance) and Part B (medical insurance), including costs and benefits.

- Call Medicare: Reach out to 1800-MEDICARE (18006334227) for assistance. TTY users can call 18774862048.

Estimating Surgery Costs:

- Procedure Price Lookup: Use this Medicare.gov tool to estimate costs.

- Consult Healthcare Providers: Ask about the costs of the procedure and any additional care needed.

- Check Your Medicare Summary Notice: Review whether you’ve met Part A or B deductibles and potential copayments.

- Verify with Other Insurance: If you have additional insurance like Medigap or Medicaid, check their coverage.

Reducing Your Costs:

Ask About Assignment: Ensure your provider accepts assignment to cover the Medicare-approved amount.

Explore Assistance Programs: Look into programs for financial assistance if you have limited income. Check the “Medicare & You” handbook or Medicare.gov.

By staying informed and proactive, you can better manage your Medicare coverage and associated costs. For further information, always refer to official Medicare resources or contact Medicare directly.

New Medicare Changes You Should Know

Medicare is continually evolving to enhance accessibility and affordability for its beneficiaries. Here are some key updates that aim to make managing your health easier and more cost-effective.

Savings on Prescription Drugs:

If you reach the catastrophic coverage phase with Medicare drug coverage (Part D), you will no longer be required to pay copayments or coinsurance.

The Extra Help program has been expanded to provide greater coverage for individuals with limited resources and income.

For certain Part B-covered drugs, coinsurance amounts may decrease if the drug’s price increase surpasses the inflation rate.

Reduced Costs for Insulin and Vaccines:

Insulin products covered under Part D will cost no more than $35 per month, with no deductible required.

Insulin used in traditional pumps covered under Medicare’s durable medical equipment benefit will also cost no more than $35 per month, with the deductible waived.

Recommended adult vaccines are now available at no cost to you.

Telehealth Coverage Adjustments:

Telehealth services remain accessible from any location in the U.S., including your home, through the end of 2024. After this period, most telehealth services will require you to be at a medical facility located in a rural area, though exceptions exist for mental health services.

Chronic Pain Management:

Medicare will now cover monthly services for treating chronic pain if you have been suffering from it for more than three months.

Enhanced Mental Healthcare:

Coverage has expanded to include intensive outpatient program services provided by hospitals, community mental health centers, and other facilities.

More Enrollment Opportunities:

If you are losing Medicaid or facing other specific situations, you may have additional opportunities to sign up for or modify your Medicare coverage.

Ongoing COVID19 Support:

Medicare continues to cover the COVID-19 vaccine along with various tests and treatments to safeguard your health.

For detailed information, refer to the specific pages mentioned in your Medicare handbook.

Medicare Resources

- For more information on Medicare Supplement, visit theMedicare.Gov “Medicare & You’ Handbook.

- Need Local Help With Medicare? State Health Insurance Assistance Programs offer personalized, one-on-one insurance counseling and Medicare assistance.

Preventive Services Covered By Medicare

Medicare provides extensive coverage for preventive services designed to help detect and address health issues before they become serious problems. Here’s an overview of the key preventive services covered by Medicare, detailing what’s included, how often they’re covered, and potential costs.

Abdominal Aortic Aneurysm Screening

Coverage: Medicare covers an abdominal aortic aneurysm screening ultrasound once in your lifetime if you’re at risk and have a referral from your doctor.

Who’s at Risk:

- Family history of abdominal aortic aneurysms.

- Men aged 65–75 who have smoked at least 100 cigarettes in their lifetime.

Costs: Free if your provider accepts assignment.

Alcohol Misuse Screening and Counseling

Coverage: Medicare covers one alcohol misuse screening per year and up to four brief counseling sessions if misuse is identified.

Costs: No charge if your provider accepts assignment. Counseling must occur in a primary care setting.

Bone Mass Measurements

Coverage: Medicare covers bone mass measurements if you’re at risk for osteoporosis, based on medical history or ongoing treatments.

Frequency: Once every 24 months, or more often if medically necessary.

Costs: Free if your provider accepts assignment.

Cardiovascular Behavioral Therapy

Coverage: Annual cardiovascular behavioral therapy visits to discuss diet, exercise, and aspirin use.

Costs: Free if your provider accepts assignment.

Risk Factors:

- High blood pressure

- Unhealthy cholesterol levels

- Diabetes

- Overweight

- Tobacco and/or alcohol use

Cervical and Vaginal Cancer Screenings

Coverage: Medicare covers Pap tests and pelvic exams for cervical and vaginal cancer screenings, including a clinical breast exam.

Frequency:

- Pap tests and pelvic exams: Once every 24 months (or annually if high risk).

- HPV tests: Once every 5 years for women aged 3065.

Costs: Free if your provider accepts assignment.

Risk Factors for Cervical Cancer:

- History of sexually transmitted diseases

- Early sexual activity

- Multiple sexual partners

- Abnormal Pap test history

Colorectal Cancer Screenings

Coverage: Medicare covers various screenings including colonoscopies, fecal occult blood tests, flexible sigmoidoscopies, and more.

Frequency:

- Colonoscopy: Every 120 months (or 24 months if at high risk).

- Fecal occult blood test: Annually.

- Flexible sigmoidoscopy: Every 48 months (or 120 months after a colonoscopy if not high risk).

Costs: Free for most tests if your provider accepts assignment. Additional costs apply if polyps are removed during a colonoscopy.

Risk Factors for Colorectal Cancer:

- Age

- Personal or family history of colorectal cancer or polyps

- Inflammatory bowel disease

Depression Screening

Coverage: Medicare covers one depression screening per year in a primary care setting.

Costs: Free if your provider accepts assignment.

Diabetes Screenings and Self-Management Training

Coverage: Medicare covers up to two diabetes screenings per year and outpatient self-management training for diagnosed diabetes.

Costs: Free for screenings if your provider accepts assignment. Self-management training may involve a 20% copayment after the Part B deductible.

Risk Factors for Diabetes:

- High blood pressure

- Obesity

- Family history of diabetes

Flu Shots

Coverage: Medicare covers the seasonal flu shot once each flu season.

Costs: Free if your provider accepts assignment.

Glaucoma Screenings

Coverage: Medicare covers glaucoma screenings once every 12 months if you’re at high risk.

Costs: 20% of the Medicare-approved amount after the Part B deductible, with possible additional copayments in hospital outpatient settings.

Risk Factors for Glaucoma:

- Diabetes

- Family history of glaucoma

- Certain ethnic backgrounds

Hepatitis B Shots and Screenings

Coverage: Medicare covers Hepatitis B shots and screenings for those at high risk or pregnant.

Costs: Free if your provider accepts assignment.

Risk Factors for Hepatitis B:

- Diabetes

- Certain occupations and conditions

Hepatitis C and HIV Screenings

Coverage: Medicare covers Hepatitis C screenings for certain risk groups and HIV screenings for individuals.

Costs: Free if your provider accepts assignment.

Lung Cancer Screenings

Coverage: Medicare covers annual low-dose CT scans for lung cancer screening if you meet specific criteria including smoking history.

Costs: Free if your provider accepts assignment.

Risk Factors for Lung Cancer:

- Smoking history

- Exposure to secondhand smoke or cancer-causing agents

Mammograms (Breast Cancer Screenings)

Coverage: Medicare covers annual screening mammograms for women 40 and older, diagnostic mammograms as needed, and one baseline mammogram for women aged 3539.

Costs: Free for screening and baseline mammograms; 20% of the Medicare-approved amount for diagnostic mammograms after meeting the Part B deductible.

Medicare Diabetes Prevention Program

Coverage: Medicare covers this program for those at risk of type 2 diabetes, including core sessions and follow-up support.

Costs: Free if you qualify.

Obesity Behavioral Therapy

Coverage: Medicare covers screenings and counseling for obesity with a BMI of 30 or more.

Costs: Free if your provider accepts assignment.

Pneumococcal Shots

Coverage: Medicare covers pneumococcal vaccines to protect against pneumonia.

Costs: Free if your provider accepts assignment.

Prostate Cancer Screenings

Coverage: Medicare covers PSA blood tests and digital rectal exams for men over 50.

Costs:

- PSA test: Free.

- Digital rectal exam: 20% of the Medicare-approved amount after the Part B deductible.

Sexually Transmitted Infection Screenings and Counseling

Coverage: Medicare covers STI screenings and counseling if you’re pregnant or at increased risk.

Costs: Free if your provider accepts assignment.

“Welcome to Medicare” Preventive Visit

Coverage: Medicare covers this one-time visit within the first 12 months of having Part B.

What’s Included:

- Medical history review

- Preventive services information

- BMI calculation

- Vision test

- Depression risk assessment

Costs: Free if your provider accepts assignment.

For more information on any of these services, contact your Medicare provider or visit the Medicare website to ensure you receive the preventive care you need.